Maximizing Efficiency and Profits with the Best Financial Analytics Tools for Real Estate Industry

They trust us:

Best Financial Analytics Tools For Real Estate Industry

(soure: https://images.app.goo.gl/KKgDS9pFRVNYTco2A)

The real estate industry is a very important part of the economy and it has a lot of potentials to grow. The market is huge and there are many different players. This makes it difficult for business owners to keep track of what their competitors are doing. This is where the best financial analytics tools come into play.

The following list provides some of the best real estate analytics tools that can help you in your business:

- Market Analytics: These tools provide insights into the current market trends, upcoming opportunities, and risks in the real estate industry.

- Business Analytics: These tools help you understand your competitors’ strategies, their strengths, and weaknesses, as well as their marketing strategies through data analysis.

- Economic Analytics: These tools provide insights into how various economic factors affect your business – such as cost of living changes or tax rates – by providing historical data for comparison purposes.

These tools are not only helpful in understanding your business but also help you make better decisions and improve your ROI.

What is NetSuite?

NetSuite is a cloud-based enterprise resource planning (ERP) system that provides a unified platform for managing finance, supply chain, manufacturing, HR, ecommerce, and other business functions. It offers a single database to replace the need for disparate software, enabling companies to streamline their operations and improve efficiency.

What are the features of NetSuite?

NetSuite’s Financial Analytics software is an ERP (Enterprise Resource Planning) platform that offers various features for financial management, analysis, and reporting. The software provides flexible querying tools, role-based dashboards, operational reports, and KPIs to make better and faster decisions.

It supports a centralized platform to analyze NetSuite and non-NetSuite data. NetSuite’s financial analytics software helps in complying with regulatory requirements and enables the creation of customized reports and dashboards. The software allows combining operational and financial data to analyze statistical measures and results for each department, location, funder/donor, and more.

The SuiteAnalytics tools offer built-in ad hoc reporting, real-time dashboards, and ODBC access across NetSuite and all customizations, helping to identify issues, trends, and opportunities. The financial analytics software of NetSuite includes features such as revenue and expense modeling, approval workflows, management reporting, and powerful predictive planning that uses historical data and industry-specific statistical models to predict future results, improving the accuracy of forecasts.

Additionally, NetSuite’s financial analytics software offers a financial report builder tool that allows users to craft financial statements tailored to their specific reporting requirements, grouping financial data differently, including additional data, and customizing report layouts.

What is the pricing of NetSuite?

The base NetSuite license costs $999 per month, while access costs for the service come at an additional $99 per user, per month. Nonetheless, for a specific quote, potential clients must contact a NetSuite consultant directly.

What is Jirav?

Jirav is an all-in-one financial planning and analysis (FPA) software designed to simplify financial reporting and analysis, and empower company stakeholders with the information they need. With Jirav, you can quickly and easily design models, plans, and forecasts to accelerate growth, and customize them to perfectly fit your business.

What are the features of Jirav?

Jirav is an all-in-one financial planning and analysis (FPA) software solution designed to streamline budgeting, planning, forecasting, and reporting. Its main features include a driver-based financial model that consolidates accounting, workforce, and operational data, pre-defined templates, data visualization, and performance metrics.

Jirav offers instant integrations with popular apps like Excel, NetSuite, Intacct, QuickBooks, and Xero and has a lower implementation cost than most FPA software. It delivers real-time KPIs and powerful, intuitive dashboards that aid understanding and enable proactive decision-making.

Jirav also provides extremely powerful financial analysis, reporting, and forecasting capabilities, such as generating integrated 3-way financial statements (income statement, balance sheet, and statement of cash flows) for historical and future periods.

Additionally, Jirav offers tailored reporting, secure data sharing, and historical data tracking, making it a great financial analytics software option for small to midsize businesses that want to forecast revenue generation, gain sales insights, and reduce financial risk.

What is the pricing of Jirav?

Jirav offers three pricing plans: Starter, Professional, and Enterprise. The Starter plan costs $10,000 per year and has a 14-day free trial. The Professional plan costs $15,000 per year, and the Enterprise plan’s pricing is not provided on their website, so you will have to contact Jirav to get pricing details.

What is Spendesk?

Spendesk is a complete spend management platform that provides 100% visibility into company spend, offering a 7-in-1 solution with corporate cards, invoice payments, expense management, and more. With Spendesk, finance teams can decentralize operational spending across the business while maintaining control and visibility.

What are the features of Spendesk?

Spendesk is a comprehensive spend management solution designed to help businesses manage their expenses. Its main features include payment reconciliation, data visualization, multiple currencies, real-time reports, spend approvals, virtual and physical cards, expense reimbursements, and invoice management.

The software allows organizations to set up individual spending limits for staff members, view corporate purchase history, and track and control operational spending on a unified platform. Spendesk is flexible and customizable, allowing businesses to automate recurring expenses and match invoices to expense claims using OCR technology, saving time and improving efficiency.

Spendesk also comes with AP automation features, making it easy to manage expenses and increase spend accountability without adding anything to the back-office. Spendesk gives complete visibility and control over company spend, with a traceable workflow and validation system.

Spendesk is a fully featured expense management software that is scalable, simple, and easy to use, making it a valuable tool for finance teams and businesses of all sizes.

What is the pricing of Spendesk?

The pricing for Spendesk is flexible and varies based on the needs of each business. To get a custom quote, customers can speak with one of their experts. The pricing for Spendesk Essentials, a plan designed for SMBs, is not publicly listed on their website.

What is Qonto?

Qonto is a digital bank designed for businesses that offers a range of financial tools and services. With Qonto, businesses can easily manage their finances, track expenses, and streamline their banking operations.

What are the features of Qonto?

Qonto is a business banking solution that offers various features to help manage finances. While Qonto provides bookkeeping and reporting tools, it does not offer financial analytics software in the traditional sense.

However, Qonto offers features such as centralized invoicing, payable and receivable management, expense and spend management, and customizable limits for team spending.

Additionally, it allows users to sync with accounting tools, automate receipt collection, and auto-label transactions. These features can help businesses manage their finances effectively and stay on top of their spending.

What is the pricing of Qonto?

Qonto offers transparent pricing for all their services, starting from €9/month. The Basic plan is their entry-level plan for self-employed workers, while the Smart plan offers more features at a reasonable price point.

They also have a Premium plan which includes all their features plus priority support for €39/month (excl. VAT). Qonto provides a 30-day free trial with no commitment for interested users to try out their services.

What is Candis?

Candis is an artificial intelligence tool designed to automate a company’s financial workflows. It collects and handles all invoices and ensures timely payments, saving up to 80% of manual work.

What are the features of Candis?

Candis is a cloud-based financial analytics software that offers several features to help businesses manage their financial data and operations. One of the main features of Candis is the automated bookkeeping, which helps businesses with their accounting tasks, such as invoice management, bank reconciliation, and data entry.

This feature saves businesses time and reduces the risk of human error. Another feature of Candis is the intelligent document recognition, which extracts relevant data from invoices and receipts automatically. This feature helps businesses with invoice management by providing an accurate and organized overview of all the incoming and outgoing invoices.

Candis also provides financial reporting and analysis features, which allow businesses to create customized reports and analyze their financial data in real-time. The software provides several predefined reports, including profit and loss statements, balance sheets, and cash flow statements. Additionally, Candis offers bank connectivity, which enables businesses to connect their bank accounts to the software and retrieve financial data automatically.

Moreover, Candis has a user-friendly interface, making it easy for businesses to use the software without prior technical knowledge. The software is also scalable, allowing businesses to add or remove features based on their changing needs. Finally, Candis provides a high level of security and data privacy, ensuring that financial data is kept safe and confidential.

What is the pricing of Candis?

The pricing for Candis starts at €249 per month. They do not offer a free trial or a freemium version of their software. There is no entry-level set up fee for their service. For the latest pricing information, it is recommended to visit their website.

What is Bill?

Bill.com is a cloud-based platform that offers solutions to automate billing and invoicing processes for small and medium-sized businesses. The tool enables users to customize approval workflows and flexible payment options, including ACH, credit card, and check payments.

What are the features of Bill?

Main features typically offered include consolidation of financial data from multiple systems, standard accounting metrics and KPIs, report hierarchy management, email export and scheduling, and integration with other tools.

Additionally, some financial analytics software may offer more advanced features such as AI-powered forecasting, visual dashboards, cash flow and what-if analysis, industry benchmarking, and more. If you have more specific information about the Financial Analytics software Bill, I would be happy to try and provide a more tailored response.

What is the pricing of Bill?

Bill.com offers various pricing plans for its users. The plans range from $29 to $59 per month per user, with the latter being the most popular plan. In addition, the platform charges $19 per approver user.

The merchant fees include international wire transfer with a $0 fee per payment and competitive exchange rates, international wire transfer (USD) at $14.99, and vendor direct virtual card payment at $0/payment.

The Pay Faster by ACH plan offers same or next day payments for $9.99, and the Pay Faster by Check plan offers overnight payments for $22.99 and two-day payments for $17.99.

What is Yokoy?

Yokoy is an AI-powered expense management tool that automates the entire expense process, from submitting receipts to exporting them to ERP systems. It also offers customized approval flows for increased transparency and control.

What are the features of Yokoy?

Yokoy is a financial analytics software that helps businesses automate and optimize their expense management process. Its main features include:

Automated expense management: Yokoy uses artificial intelligence to automatically categorize expenses and match them with receipts, saving time and reducing errors.

Customizable expense policies: Companies can set their own expense policies and rules, which are automatically enforced by Yokoy.

Real-time expense tracking: Yokoy provides real-time tracking of expenses and provides detailed analytics and reports, allowing businesses to monitor their spending and identify areas for cost savings.

Mobile expense reporting: Employees can easily submit expenses and receipts through the Yokoy mobile app, which is available for iOS and Android devices.

Integration with accounting software: Yokoy integrates with popular accounting software such as Xero and QuickBooks, making it easy to export expense data and reconcile accounts.

Multi-currency support: Yokoy supports over 160 currencies, making it ideal for businesses with international operations.

Corporate card management: Yokoy allows businesses to issue corporate cards to employees, with customizable limits and restrictions, and tracks all transactions made with the cards.

Receipt scanning and storage: Yokoy can automatically scan and store receipts, reducing the need for manual data entry and paper receipts.

Overall, Yokoy streamlines the expense management process, reduces the risk of errors and fraud, and provides valuable insights into company spending.

What is the pricing of Yokoy?

Based on the search results, the pricing model for Yokoy is quotation-based and customizable. There is no fixed pricing mentioned on their website or other sources, and the pricing is determined based on the custom features and integrations needed for the business.

Yokoy offers features such as active fraud prevention, audit-proof, on-the-go real-time tracking, automated VAT-readout, trips and auto lump sum calculation, AI scanning, and data analytics. For more information on Yokoy’s pricing and features, potential users can reach out to the company for a customized quotation.

What is Biller Genie?

Biller Genie is a cloud-based software that automates accounts receivable, including bill presentment, follow-up, collection, and reconciliation. It streamlines the invoicing process and improves cash flow by simplifying accounts receivable management.

What are the features of Biller Genie?

Biller Genie is a financial analytics software that offers several features for small and medium-sized businesses. The main features of Biller Genie include automated invoicing, payment reminders, payment tracking, and a customer portal.

The software integrates with several payment gateways, including Stripe, PayPal, and Authorize.Net, making it easy for businesses to receive payments from their customers. Biller Genie also offers an automated follow-up feature, which sends reminder emails to customers who have not yet paid their invoices.

The software also allows businesses to create custom payment plans and payment schedules for their customers. Additionally, Biller Genie provides detailed financial analytics and reporting, including cash flow statements, aging reports, and revenue analysis, which help businesses gain insights into their financial performance.

Overall, Biller Genie is a comprehensive financial analytics software that can help businesses streamline their invoicing and payment processes, while also providing insights into their financial performance.

What is the pricing of Biller Genie?

Biller Genie offers pricing plans starting at $24.95 per month, according to their website. They also offer a free plan, and interested users can schedule a 1-on-1 demo to learn more about the product. Additional pricing details can be viewed by visiting their pricing page.

What is AccountsIQ?

AccountsIQ is a cloud-based financial management platform that provides automated accounting and reporting features, multi-currency consolidation, and business intelligence tools. Its expert implementation team helps businesses scale and gain real-time insights into their performance.

What are the features of AccountsIQ?

AccountsIQ is a financial analytics software designed to provide businesses with real-time insights and intelligent accounting. Some of its main features include:

Cloud-based: AccountsIQ is a cloud-based solution, making it accessible from anywhere with an internet connection.

Multi-currency support: The software supports multiple currencies, enabling businesses to transact in various currencies.

Bank feeds: AccountsIQ automatically pulls bank transactions and statements to reconcile bank accounts with ease.

Automated workflows: The software automates accounting workflows and reduces manual data entry, saving time and improving accuracy.

Consolidation: AccountsIQ allows businesses to consolidate their financial data across multiple entities and subsidiaries, making it easier to manage financial data.

Customizable dashboards: The software offers customizable dashboards that provide real-time insights into business performance.

Reporting and analysis: AccountsIQ provides a wide range of customizable financial reports and analysis, enabling businesses to gain actionable insights.

Integration: AccountsIQ integrates with various third-party systems, including CRM, payroll, and project management software.

Compliance: The software helps businesses maintain compliance with accounting regulations and standards, reducing the risk of errors and penalties.

Audit trail: AccountsIQ provides a comprehensive audit trail of financial transactions, enabling businesses to track changes and maintain data integrity.

What is the pricing of AccountsIQ?

AccountsIQ offers pricing plans starting from £199/month. The Essentials plan (AIQ1) includes basic features such as accounts receivable, accounts payable, AP inbox, VAT with MTD, bank feeds with auto-recognition, e-payments, and multi-currency transactions.

The pricing is based on the required functionality/modules and the number of entities. For more detailed pricing information, interested customers can directly contact AccountsIQ.

What is Invoiced?

Invoiced is a B2B invoicing network that provides a secure way to send and receive invoices, pay vendors and get paid. It is a hub for all your invoicing and payment needs.

What are the features of Invoiced?

Financial analytics software is designed to provide in-depth insights into a company’s financial status and to improve financial visibility, profitability, and the value of the business for stakeholders. Financial analytics software is often used to evaluate past financial decisions, monitor current financial performance, and strategize for future financial investments.

Common features of financial analytics software include customizable tagging capabilities, the ability to measure and manage assets such as cash and equipment, and the ability to generate reports and dashboards for offline access or automated emailing.

Financial analytics software may also integrate with other financial tools, such as accounting and payroll software. Overall, the specific features of financial analytics software can vary depending on the software provider, the intended use case, and the target user base.

What is the pricing of Invoiced?

The pricing of Invoiced ranges from $100 to $500 per month. Additionally, they offer a 14-day free trial for interested customers, and there are no monthly costs, fees on refunds, or foreign transaction fees. Payment processing fees for credit and debit cards are 2.9% + $0.30 for all major card brands, while ACH is available in the US only and costs 0.8% + $0.30 (max $5). Invoiced also charges $15 for chargebacks and insufficient funds returns.

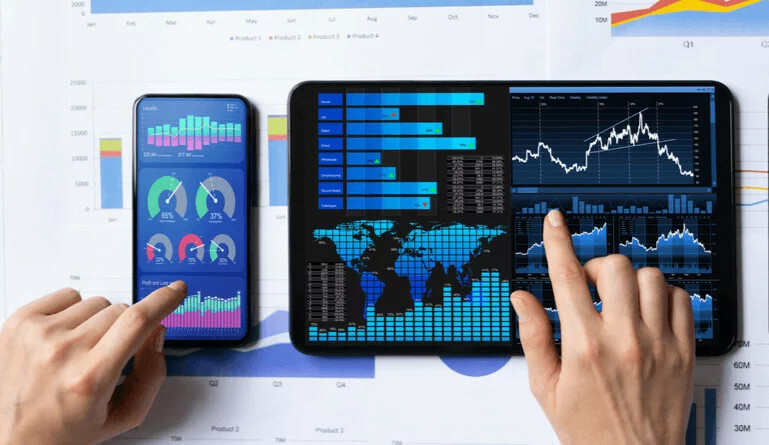

What are Financial analytics tools?

(source: https://images.app.goo.gl/reWoyv4FBCoh1Jg89)

Financial analytics tools are used to provide insights into financial performance. They help to analyze trends in financial data and identify opportunities for improvement. Financial analytics tools are software that helps people to find patterns in financial data. They provide predictive analytics and insights into how the market is performing. They can be used by investors, analysts, executives, and traders.

The market is constantly changing and so are the needs of people who work in the financial industry. This is why it’s important for them to have a tool that can help them make decisions quickly and efficiently.

Why should Real Estate companies use Financial analytics tools?

Real estate companies are constantly looking for ways to improve their performance and increase their revenues. One of the ways to do this is by using financial analytics tools.

- Real estate companies can use these tools to identify trends in the market, assess the risk levels of certain investment opportunities, and forecast future profits.

- Real Estate companies are always looking for ways to increase their profitability. Financial analytics tools help them do that by providing actionable insights on how they can improve their business.

- Real estate companies are constantly challenged with the task of finding new ways to grow their business and increase in value.

- The most important step is to identify opportunities for growth and how these opportunities can be achieved.

Financial analytics tools help companies in this process by providing insights into their financials. They help them understand how to target specific markets, improve their ROI, and better manage their cash flow.

What features should Financial analytics tools include for Real Estate agents?

(source: https://images.app.goo.gl/gT65MfUWTc4YGYMZ8)

The role of financial analytics tools in the real estate industry is to help agents make better decisions. Real estate agents are faced with a lot of obstacles when they are trying to market their properties. One of the biggest problems is getting accurate financial analytics tools that can provide them with the data they need to make smart decisions.

The following features would be ideal for financial analytics tools for real estate agents:

- Real estate agent-friendly interface: The interface should be easy to use and allow for quick access to all the information needed by agents.

- Mobile compatibility: The tool should be able to work on mobile devices so that agents can use it from anywhere and at any time.

- Data integration: Data from multiple sources should easily integrate into one platform so that real estate agents have more options when it comes to how they want their data displayed.

Real estate agents are professionals who help people buy or sell their homes. They provide data and analytics to help them make decisions about their business. In order to be successful, real estate agents need to have the right tools at their disposal.

This is because they often have a lot of information that they need to manage and organize in order to make informed decisions about their clients.

What types of integrations are important with Financial analytics tools for Real Estate agents?

The use of financial analytics tools in the market is growing rapidly. The reason for this is that they are able to provide a wealth of information about their client’s finances. The best part about these tools is that they provide insight into how their clients’ finances are changing over time.

The following are some of the different types of integrations that are important for real estate agents:

- Integration with CRM systems can help to increase productivity by providing more data to the agent and their team, and it also helps in streamlining a process by providing more insights on how best to market a property.

- Integration with social media platforms like Facebook, Twitter, LinkedIn, Instagram, etc. can help in building a brand identity and also in increasing visibility among prospective clients.

The importance of integrations with financial analytics tools for real estate agents is often overlooked. The ability to integrate these tools with other systems and platforms is important for real estate agents.

What are the benefits of using Financial analytics tools for Real Estate companies?

(source: https://images.app.goo.gl/cfzsKKbdpzrssH4Z8)

Real estate companies can easily use financial analytics tools to gain a competitive edge. Financial analytics tools allow real estate companies to get a better understanding of their business and the market.

They provide insights into the market trends, which helps them decide on the best time to invest or sell their property. Financial analytics tools help real estate companies to save time and money by providing them with insights into their business. They also help them to make better decisions. The benefits of using financial analytics tools for real estate companies are:

- Analyze your current financial situation and make informed decisions about your business.

- Detect trends in performance so that you can take appropriate action to improve it.

- Make sure that you have the right data, the right way, and in the most timely manner possible.

- Reduce costs by eliminating redundant or unnecessary tasks such as manual reporting or manual data entry.

- Increase productivity by streamlining processes and automating workflows.

- Improve customer satisfaction by providing faster responses, more customized services, and personalized interactions with customers

Real estate companies can also use these tools to understand how much money they are making from each transaction and how much profit they can make with each sale. This is crucial for them as it helps them decide whether or not it is worth investing in a new property or selling an old one.

How to choose the right Financial analytics tool for your Real Estate business?

(source: https://images.app.goo.gl/WaKYAGTaeB2YfeKU90

There are many different types of financial analytics tools available for business owners and investors these days. In order to choose the right one for your business, it is important to understand the various functionalities that each tool has.

There are several key aspects to consider when you’re looking for a new financial analysis tool including what type of data you need, how often you need it, how much time you want your team to spend on it, and what level of support you want from the vendor.

The following are some of the key factors that you should keep in mind while choosing a financial analytics tool:

- What is your budget?

- What level of expertise do you have?

- Do you have specific needs?

Real estate is one of the most lucrative businesses. And, it is also one of the most challenging industries to manage. The key to success in this industry lies in understanding your client’s needs and providing them with relevant information.

How much do the Financial analytics tools cost for the Real Estate industry?

(source: https://images.app.goo.gl/7RoTHJ2UjdwNAUXu6)

The cost of financial analytics tools varies depending on the type of tool, the features that it offers, and the number of users. The cost of financial analytics tools for real estate is largely dependent on

- The type of tool

- The features that it offers

- The number of users:

The cost of Financial analytics tools for the Real Estate industry can vary depending on the size of the business, and the complexity of data and features. The cost can range from $5,000 to $75,000. The average cost is $25,000.

Why are Financial analytics tools important for the success of your Real Estate business?

Financial analytics tools are important for the success of your Real Estate business. They help you to analyze financial data and make better decisions about what to do next.

Some of these tools also help you to manage your finances better and track the progress of your business.

Some of the most common financial analytics tools include:

- Property management software that helps you manage your properties and track their progress

- Financial software that helps you create budgets, forecast future expenses, analyze revenue streams, and compare performance with other businesses

- Analytics software that helps you understand customer behavior and how they interact with your property or service in order to improve it

Financial analytics tools provide real-time data on various metrics such as cash flow, sales, inventory, and much more. These metrics are important for making decisions that will improve the financial health and performance of your company.

How to implement Financial analytics tools as a realtor?

Real estate is a highly competitive industry. With the number of agents and buyers increasing, it is difficult for realtors to acquire new clients. Financial analytics tools are widely used in the financial sector, but they can also be used by realtors who want to gain more information on their clients.

These tools help them understand their client’s needs and make better decisions on what property they should buy or sell. Financial analytics tools are gaining popularity as a way for realtors to manage their business. These tools help realtors to understand their market better, make better decisions, and also increase the ROI of their properties.

In order to implement these analytical tools in your business, you first need to develop a strategy that will help you get the most out of them. There are a number of different financial analytics tools that real estate firms can use to help them understand their business.

- One such tool is the Alexander Technique, which helps real estate firms track and analyze key performance indicators (KPIs) like square footage sold, square feet leased, or average rent prices.

- Another tool that real estate firms can use is theCrowdfunding Power Index, which helps identify any areas in which they could see improvement.

Additionally, real estate firms can use market data to help them make better decisions about pricing and marketing their properties.

Which type of real estate companies should buy Financial analytics software?

Real estate companies should buy Financial analytics software to understand their business more and improve their performance. Real estate companies can use financial analytics software to get a better understanding of their business and improve their performance.

The software can also help them make more informed decisions on which type of real estate company they should be. Financial analytics software is a tool that helps businesses to improve their financial performance and make better decisions. The following are some of the different types of real estate companies that should buy this software:

- Real estate developers

- Real estate brokers

- Brokers with multiple offices

- Real estate agents

The software provides a range of features that are beneficial for companies in the real estate industry. These features include customizing reports, improving efficiency, and automating processes.

Final thoughts on using Financial analytics tools for real estate agents

(source: https://images.app.goo.gl/hXgEy1igWdjwQrMv9)

Final thoughts on using Financial analytics tools for real estate agents:

- The tools are easy to use,

- They help you decide which marketing channels are working best,

- You can see how much money your efforts are bringing in and what your ROI is.

The most important thing is that these analytics tools allow real estate agents to make better decisions about their business operations with the data provided by these tools. These tools give them insights into their business operations which helps them make better decisions about their marketing strategy, pricing, lead generation, etc.

Top 10 Financial analytics tools for real estate agents

| NetSuite | |||

| Jirav | |||

| Spendesk | |||

| Qonto | |||

| Candis | |||

| Biller Genie | |||

| Bill | |||

| AccountsIQ | |||

| Invoiced | |||

| Yokoy |